Blog

The fundamentals of stakeholder strategy

A practical guide to tailored stakeholder management, offering strategies and tools to identify, map, and nurture relationships.

Organisations today face the challenge of balancing business goals and environmental, social, and governance (ESG) responsibilities amidst growing sustainability awareness and social media misinformation.

PR and communications professionals are instrumental in this process, developing and executing effective communication strategies for ESG initiatives. They also play a pivotal role in ensuring ESG communications are authentic, transparent, and in line with organisational values and actions.

Using media intelligence, you can learn who is driving the ESG conversation, allowing you to better understand the motivations, perspectives, and influences that should shape ESG initiatives and strategies.

Drawing on Isentia data, ESG coverage volume increased every month in 2023, reaching a peak of 22,700 in May and gradually decreasing in June and July. The increase in May coverage is a result of the government announcing several ESG initiatives in an energy-focused Federal Budget.

Stakeholder’s growing interest in sustainability and responsible business practices has led to increased focus on reporting, analysing, and discussing ESG topics in the media. These topics include renewable energies, shareholder engagement, and social impact.

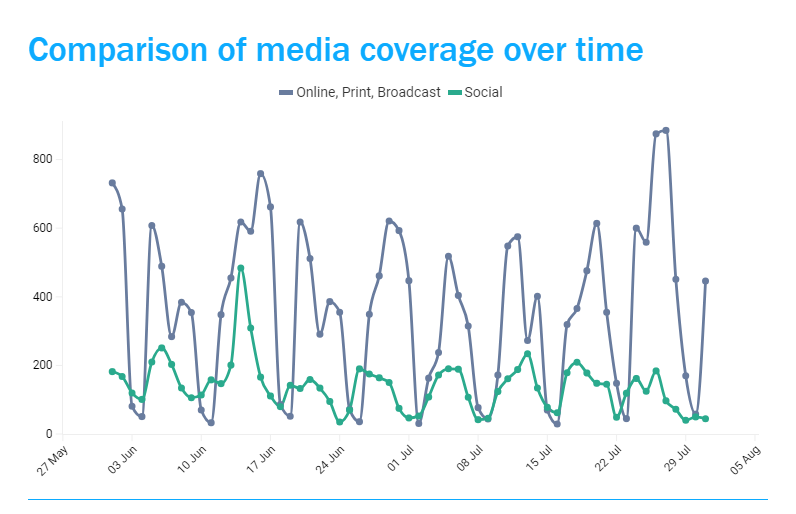

The below chart shows the fluctuations in conversations across traditional and social media between June 1 – July 31 2023. The data shows that ESG-related conversations are driven by the media, which has a substantial impact on shaping public opinion. Futhermore, this suggests that traditional media is more effective at reaching a wider audience and generating greater coverage for ESG-related topics compared to social media. It also helps in making more informed decisions about media strategy and resource allocation.

With ESG becoming a corporate imperative, there is an intensifying need for organisations to be authentic and transparent with their ESG communications. The need to do this is to:

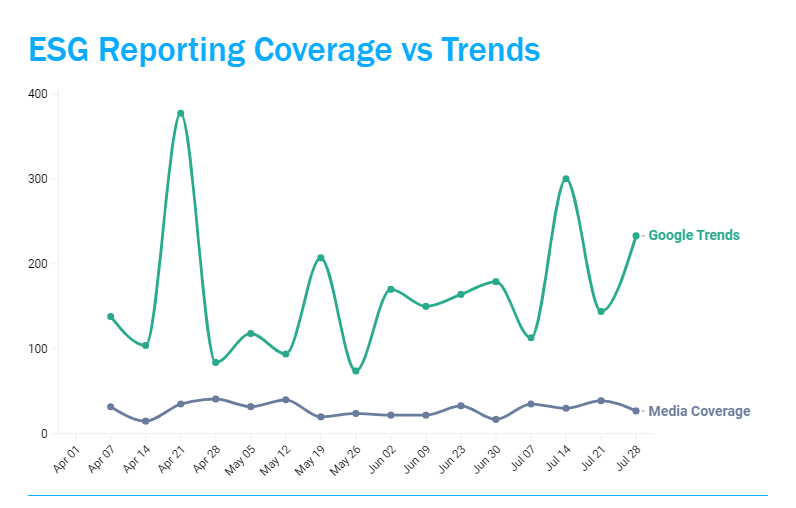

ESG reporting is becoming more prevalent among organisations, and the push for greater transparency and accountability is widespread. While the level of disclosure may vary across industries, regions, and organisations, the overall trend is towards more transparency.

This increase in reporting is expected to continue as sustainability and responsible investing gain more prominence. According to the 2022 Australian Securities and Investment Commission (ASIC) reporting trends report, 140 ASX200 companies have shown the highest levels of ESG disclosure, a rise of over 10% compared to 2020.

The chart data shows that more people are searching for ESG reports online compared to mentions of ESG reports in the media. This suggests that there is an increasing public demand to access organisational sustainability reports, ESG disclosures, and public commitments to responsible practices.

The ESG movement is gaining momentum, indicating a shift towards a more holistic and responsible approach to business and investment. This shift is influenced by ethical, financial, and regulatory factors and can be further understood through media intelligence. Additionally, by utilising media intelligence, you can identify the influences and emerging conversations surrounding these factors in traditional media.

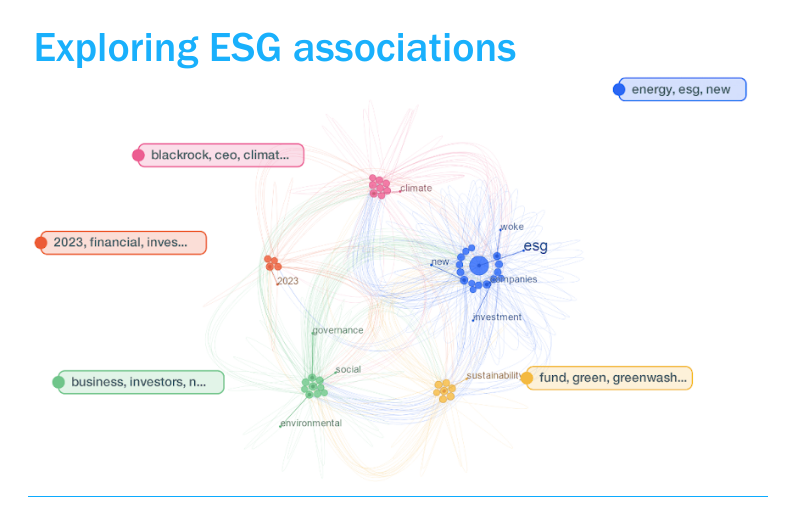

With an added layer of social data from our sister company, Pulsar, you can gain a deeper understanding of the impact of your communications and identify the key influencers and factors shaping the ESG narrative. The chart below illustrates the connections between different narratives through keyword associations.

Prominent keyword groupings such as financial markets, superannuation funds, greenwashing, and business and investors suggest these topics are interconnected with the general public. These conversations play a role in shaping their decisions and opinions.

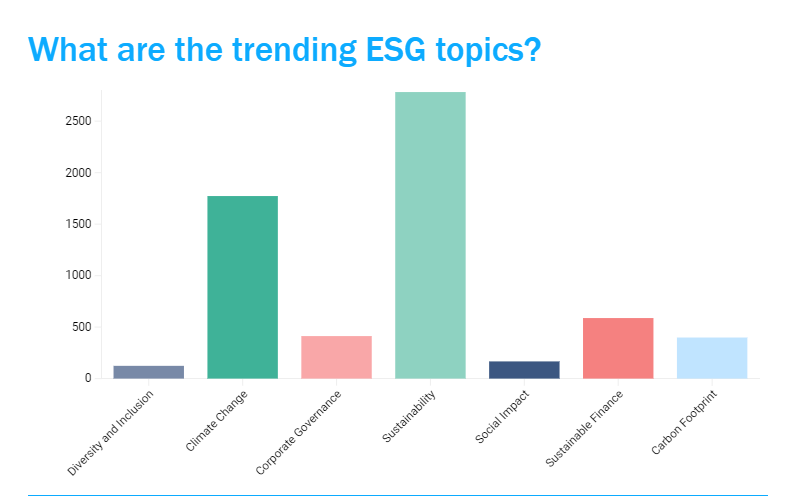

Sustainability and climate change are crucial topics for Australians, with strong community support for transitioning to a net-zero economy and addressing climate-related issues.

Consumers are also showing a growing interest in sustainable finance and reducing their carbon footprint. While the chart below shows that Diversity, Equity, and Inclusion is currently the least trending topics, organisation’s are increasingly being urged to address gender disparities, promote equal opportunities, and foster inclusive workplaces that value diversity.

Australian super funds are embracing ESG investing as enthusiastically as their corporate equivalents, recognising the potential for long-term sustainable performance.

ASIC, the superannuation industry regulator, focuses on tackling greenwashing, the misrepresentation of environmental, sustainable, or ethical attributes in financial products. As Australians grow more concerned about their super fund investments, ASIC emphasises the need for funds to substantiate their ethical claims with evidence.

The boundaries of ESG are subjective, allowing super funds to decide which investments they consider ethical and whether they engage with or divest from socially or environmentally harmful companies. Emphasising socially responsible investments and adopting a broad definition of ESG can enhance the superannuation industry’s reputation and individual performance.

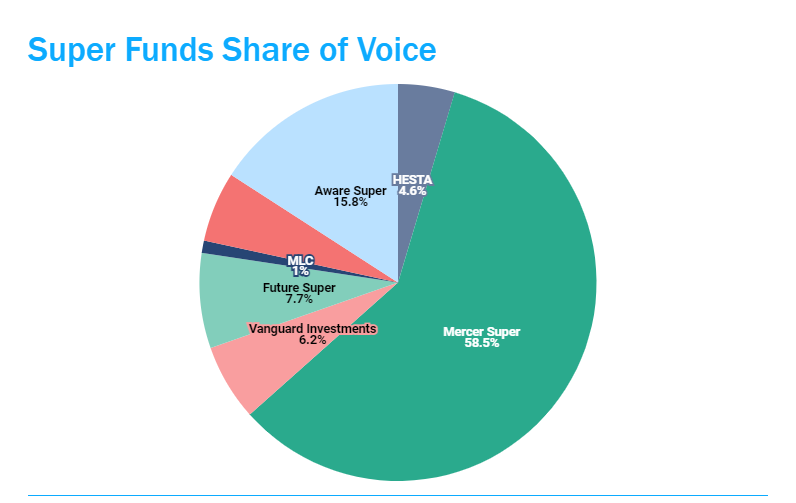

From the below chart, Mercer Super holds the largest share of voice among Australian superannuation companies, with over 50 percent. ASIC has accused the organisation of greenwashing its investments by misleading members about the exclusion of carbon-intensive fossil fuel companies. Unsurprisingly, these allegations have gathered significant media coverage and attention in the industry.

Communicators shape ESG narratives, aligning them with corporate purpose and finding the perfect balance between aspiration and impact.

Using media intelligence for ESG success: gain insights into stakeholder concerns, competition, reputation management, and communication strategies for effective outcomes. By leveraging media intelligence, you can make informed decisions and enhance your organisation’s sustainability initiatives.

To discover how media intelligence can assist your organisation in measuring its ESG efforts, simply fill out the form below.

Loren is an experienced marketing professional who translates data and insights using Isentia solutions into trends and research, bringing clients closer to the benefits of audience intelligence. Loren thrives on introducing the groundbreaking ways in which data and insights can help a brand or organisation, enabling them to exceed their strategic objectives and goals.

A practical guide to tailored stakeholder management, offering strategies and tools to identify, map, and nurture relationships.

Explore how journalism shapes trust, audience engagement, and media influence in Australia and New Zealand.

Get in touch or request a demo.