Blog

The fundamentals of stakeholder strategy

A practical guide to tailored stakeholder management, offering strategies and tools to identify, map, and nurture relationships.

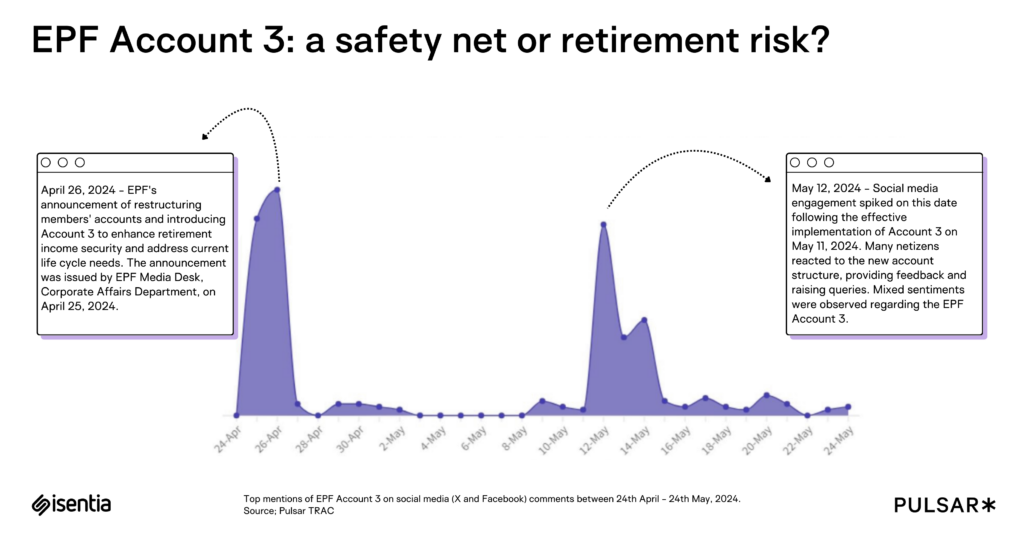

Malaysia’s financial narrative is currently shaped by two significant developments: the introduction of EPF Account 3 for flexible savings and the ongoing discourse surrounding the depreciation of the Malaysian Ringgit (MYR). While reactions to the EPF Account 3 were mostly positive, the uncertainty around distribution of funds across accounts contributed negatively to the conversation. Similarly, there was significant government criticism for the weakening of the Malaysian Ringgit with audience conversations peaking around the effects of the depreciation like losing confidence in the economy and rise in job emigration. Together, these topics highlight the economic challenges and opportunities facing the nation, with implications extending across Southeast Asia.

Social media reactions to EPF Account 3 reflect mixed sentiments. Positive feedback centered on the financial relief and flexibility it offers, while criticism highlighted the complexities of withdrawal processes and doubts about its long-term viability. Neutral comments often underscored the need for more clarity and public awareness. These insights emphasize the importance of transparent communication to foster trust and maximize the plan’s impact.

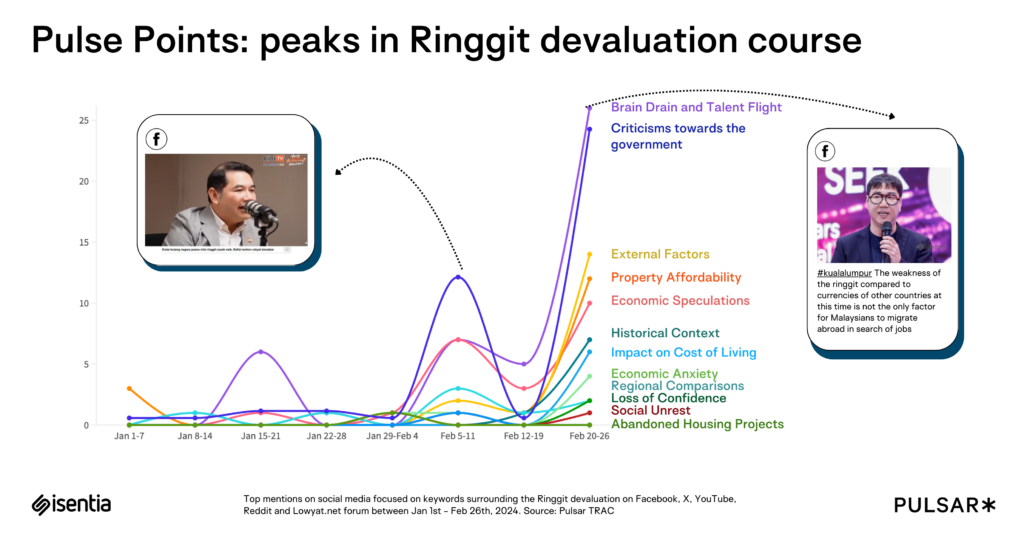

Analysing the more economical aspects of the nation, the depreciation of the Malaysian Ringgit has sparked widespread discourse, with criticism of the government’s economic strategies dominating conversations. Brain drain and talent flight emerged as a top narrative, fueled by concerns about reduced purchasing power and economic opportunities abroad. However, the government’s focus on structural reforms over quick fixes demonstrates a long-term commitment to stabilizing the economy and restoring public confidence.

Malaysia’s recovery strategy for the Ringgit includes fostering investor confidence, diversifying the economy, and strengthening social safety nets. Efforts to promote trade agreements and prioritize local economic growth highlight a proactive approach to addressing both domestic and global factors affecting currency value. This strategy, if effectively implemented, could serve as a model for other Southeast Asian nations grappling with similar economic challenges.

Both the EPF Account 3 initiative and the Ringgit recovery efforts underscore Malaysia’s adaptability in the face of economic pressures. As the nation works to stabilize its economy and provide safety nets for its citizens, these efforts serve as a blueprint for financial resilience across Southeast Asia. Transparent communication and sustained policy action will be key to achieving long-term success.

Want to catch up to our latest insights and reports? Contact nikita.gundala@isentia.com to learn more.

A practical guide to tailored stakeholder management, offering strategies and tools to identify, map, and nurture relationships.

Across the communications landscape, teams are being asked to do more with less, while staying aligned, responsive and compliant in the face of complex and often shifting stakeholder demands. In that environment, how we track, report and manage our relationships really matters. In too many organisations, relationship management is still built around tools designed for […]

Get in touch or request a demo.