Blog

The fundamentals of stakeholder strategy

A practical guide to tailored stakeholder management, offering strategies and tools to identify, map, and nurture relationships.

Next week’s Federal Budget has many Australians wondering how they will be affected.

The government has strongly advocated for building a more resilient economy than their predecessors, yet in recent months, the economy is suffering due to a rapid rise in inflation. This has pushed up interest rates and is squeezing the cost of living with both consumers and businesses feeling the pressure.

Following groceries, the leading financial stressors for Australians are petrol, rent, mortgage payments and energy bills. And just to make ends meet, Aussies are making more considered purchases, seeking higher paying employment or working multiple jobs. Australians are already anxious about inflation with growing concern there’s no end in sight.

Will the government restore their trust in Australians and keep their pre Federal Budget promises?

Latest data from CHOICE’s Consumer Pulse survey, revealed that cost of living pressures are a major concern, with 90% of Australians seeing an increase in their household bills and expenses over the past year.

Inflation pressures are intensifying and the Reserve Bank of Australia (RBA) continues to drive up interest rates – their highest level in 7 years. The government has promised a long-term and sustainable approach to cost of living support in the form of a relief package.

Concerned about their mortgage payments, up to a third of mortgage holders could struggle to keep up with future repayments, with younger generations particularly concerned about surging interest rates.

Using Isentia data, during an eight week period from early August to early October 2022, 18% of Australia’s front pages featured cost of living stories. Even in a time of large local and international news such as the war on Ukraine and the Optus security breach, the cost of living crisis was still making front page news.

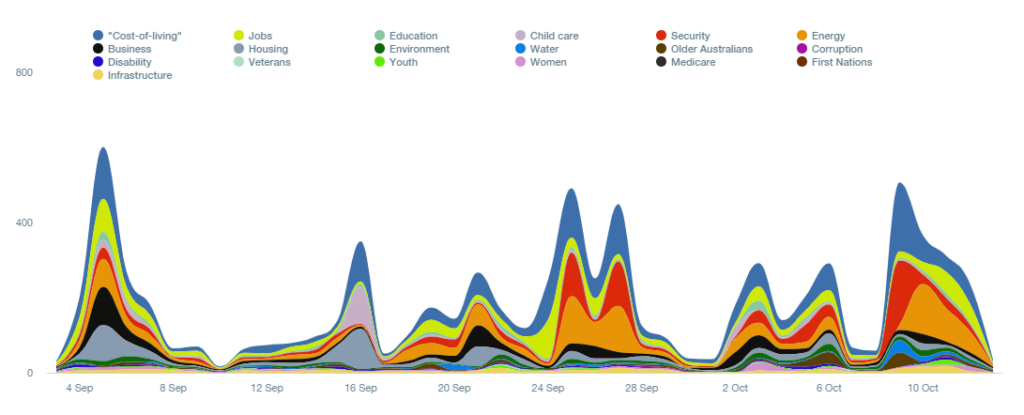

According to Pulsar data, anxieties around the cost of living, peaked following the RBA’s interest rate announcements on 4 September and 4 October. For the sixth consecutive month, Australians have had to tighten an already lean household budget.

Apprehensions around security increased on 24 September as a result of the Optus security breach and again on 10 October when the government announced changes to the country’s defence projects. Also on 10 October, cost of living concerns spiked after growing speculation surrounding the Stage 3 tax cuts being recalibrated. Australians also felt a heightened sense of unease after the announcement of a future surge in energy costs, following a recent 35% rise.

Childcare fees are at their highest in 8 years, with child care subsidies failing to keep out of pocket costs to a minimum. On 16 September, conversation around child care spiked, as Treasurer Jim Chalmers promised to reduce the cost of childcare, yet pledged to keep spending restrained in light of budgetary constraints.

As part of the cost of living relief package, this reduction won’t come into play until mid 2023. Can Australian families wait this long?

Problematic climate conditions such as excessive rain and floods are leading to localised food price increases and diminished food quality. Even in the same area, poorer households are faring far worse than affluent counterparts. Across the board, there has been a surge in the cost of fruit and vegetable prices (7.3%) and meat, seafood and bread rising by 6.3%.

On top of these climate issues, labour shortages in both warehousing and transportation have resulted in added disruption to the supply chain. Freight costs are on the rise, putting intense pressure on importers and exporters.

Are Aussie consumers looking at a continued supply chain that is more disruptive than the 2020 toilet paper shortage? The rise in the cost of living weighs on households’ spending, and Australians are seeking alternate ways to make extra cash.

As the cost of living rises, many Australians are seeking alternate ways to make or save cash; trimming budgets where they can; cancelling home entertainment subscriptions, and reducing insurance coverage for lower fees to name a few. Purchases at all levels are becoming more involved and highly considered, with discounts heavily sought after.

As Millennials and Gen Z shoppers are gaining more buying power, their passion for sustainable commerce is stronger than ever. Selling personal items to make extra cash has been on the rise with retail e-commerce platforms such as Facebook Marketplace and ‘Recommerce’ platforms like AirRobe, are booming. Not only are Australians becoming more financially savvy, they are conscious of the need to ‘reduce, reuse and recycle’ – a criteria these platforms adopt.

There’s no doubt that inflation is changing salary expectations. And for those in industries where movement and remote working is possible, many Australians are following the money.

Data from the Reserve Bank of Australia, shows organisations have reported higher rates of employees leaving to achieve higher pay packets as a way to provide temporary relief for the rise in cost of living. Interestingly, this higher voluntary turnover was especially concentrated in professional services.

In response to labour shortages, organisations are implementing a range of non-base wage strategies – e.g bonuses, flexible work practices, more internal training and hiring staff with less experience, as opposed to increasing base wages.

Australian Bureau of Statistics (ABS) figures also show Australians are taking on multiple jobs, as full-time work forces employees to juggle several roles to make ends meet. Although multiple job holding is more common in low-paid industries, a record high of 900,000 people held multiple jobs in the June quarter of 2022.

This is an increase of 4.3 per cent from the previous quarter and is a reflection of wages growth stagnating and nominal wages barely keeping up with consumer prices. The result; people needing to work more hours to make ends meet.

Using data insights from Pulsar, wages is one of the ‘most anticipated’ topics in this year’s Budget. The Wage Price Index (WPI) rose 0.7 per cent in the June quarter and 2.6 per cent over the year, which represented a substantial fall in real wages given inflation rose 6.1 per cent last quarter.

Social media conversation around wages is evolving with other indicators suggesting wages are still climbing alongside extreme uncertainty surrounding global growth and rampant inflation.

Will Australians see more dollars in their pocket after the Budget is handed down?

With Australians taking a greater interest in living a sustainable lifestyle, the government and organisations are prompted to influence the lever of positive change and create actionable outcomes.

Despite a great deal of politicians pledging change, governments are often swayed by the media and public opinion which can derail policies wanting to address complex, longer-term challenges. Millennials and Gen Zs have long pushed to see societal and economic change.

Results from the 10th Annual Deloitte Global 2022 Gen Z and Millennial Survey shows they are increasingly becoming more politically involved. These influential cohorts are progressively showing interest in political issues, and turning to social media to discuss their opinions. Moreover, they are consciously making calculated career decisions and spending their money with organisations who share the same values.

Social engagement shows left wing millennials are showing concern over the budget and economic issues, with Treasurer, Jim Chalmers gaining the most chatter. Similarly, baby boomers are equally vocal, using the same keywords as millennials but they also seek strong leadership and a strong economy.

For younger demographics, their interactions or relationships with organisations is dependent on the organisation’s treatment of the environment, their policies on data privacy and their position on social and political issues.

For governments, tackling environmental, economic and social issues and their impact requires a huge transformation across all sectors. Market forces alone will not solve the problem, and the onus is on governments to take a lead to meet the sustainability challenge.

The October Federal Budget is an opportunity for the government to show they are the lever of change by creating actionable outcomes and a positive impact. Australians are concerned for the welfare of the country and previous governments have fallen short.

The government promises to back clean energy and build new renewable infrastructure across the country, will they succeed or disappoint?

The Federal Budget can be an overwhelming time, with an abundance of promises and policies, it can be hard to stay on top of the latest news. We have a comprehensive range of political news services available to help you navigate the political media coverage at this October Federal Budget. Want to learn what’s being said at this Federal Budget?

Click here to start navigating the announcements that may impact your organisation.

Loren is an experienced marketing professional who translates data and insights using Isentia solutions into trends and research, bringing clients closer to the benefits of audience intelligence. Loren thrives on introducing the groundbreaking ways in which data and insights can help a brand or organisation, enabling them to exceed their strategic objectives and goals.

A practical guide to tailored stakeholder management, offering strategies and tools to identify, map, and nurture relationships.

Across the communications landscape, teams are being asked to do more with less, while staying aligned, responsive and compliant in the face of complex and often shifting stakeholder demands. In that environment, how we track, report and manage our relationships really matters. In too many organisations, relationship management is still built around tools designed for […]

Get in touch or request a demo.